Year End 2023 Double Eagle Partners Investor Letters

A New Year’s K.I.S.S.

I like to maintain my father’s mantra, K.I.S.S. or “Keep It Simple Stupid.” Why complicate

things in your life when life is complicated enough already?

That goes for investing and managing our portfolios at Double Eagle Partners. I want my

partners to focus on the long term and invest for reasons that are entirely relevant to

you and your investment objectives and risk tolerances. After all, your ultimate goal is to

provide for your family’s future.

As a solopreneur, I do not have the luxury of making mistakes and wasting time in my

investment practices. I strive to avoid bad investing habits like trading too often or

following the crowd as they get swayed by short term price movements and the talking

heads on CNBC. In our age of “FOMO,” fear of missing out, one should remember a

great quote from the recently departed Charlie Munger of Berkshire Hathaway, “The

world is not driven by greed. It’s driven by envy.” Let us not fall into either of those

camps with our investment decisions.

We also must remember the old adage “it’s not about timing the market, but about time

in the market!” Did you know that since 1950, the market (as defined by the S&P 500)

has had positive returns 100% of the time over any given 15-year period. That is a

comforting fact to help us remain focused on investing for the long term.

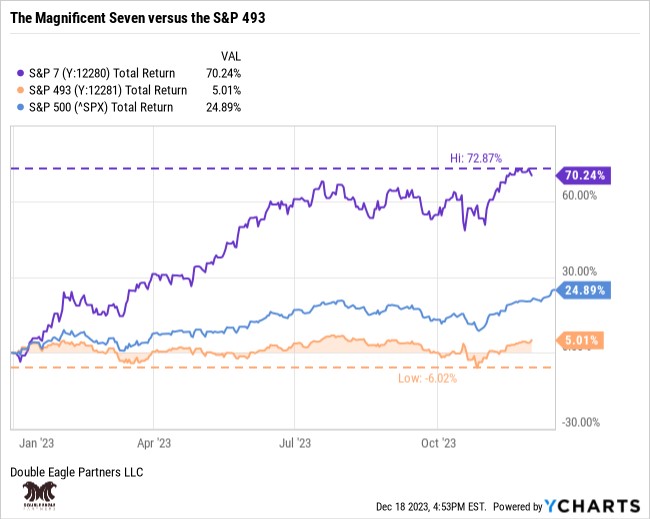

When we look at the chart below and ascertain what has happened in the equity

markets in 2023, the real question shouldn’t be “Why weren’t we 100% invested in the

Magnificent Seven?” (We discussed that in last month’s letter) but why was market

breadth so bad with the other 493 stocks in the S&P 500 only returning 5% this year?

Could it be that financial storms are on the horizon? Will corporate earnings continue to

disappoint next quarter, and could we face another banking crisis again next year? Will

the resumption of student loan payments hurt consumer spending? Will the everexpanding US Government debt load cause higher inflation with higher interest rates

that the Fed can no longer control? Could this lead to a collapse of the US Dollar? The

“Gold Bugs” and global Central Bankers seem to think so as gold is hitting all-time highs

because of record demand from foreign central banks this year. Even Costco has gotten

in on the gold bug craze and has sold more than $100 million dollars worth of gold

coins in their retail stores just in the last quarter!

Economists usually claim that markets are rational, but logic has proven no impediment

to the market pricing for a “Utopian” scenario of lower interest rates, rising asset prices,

low inflation, no recession and no major wars. Utopia and eutopia are two terms that are

often used interchangeably, but they have distinct differences that are important to

understand. Utopia, coined by Sir Thomas More in 1516, means “no place” or

“nowhere.” It describes an imaginary place or society that is perfect in every way. We

should not plan our investments around an unachievable goal of “perfect”. On the other

hand, eutopia, derived from the Greek words “eu” meaning good and “topos” meaning

place, means “good place.” It refers to an ideal society that is not necessarily perfect, but

rather a place where people are happy and content with their lives. While the terms

utopia and eutopia are often used interchangeably, they have distinct differences that

are important to understand. Utopia may not be possible to achieve, while eutopia

refers to a good society that is actually achievable, and maybe that is what we really

need in the world today and in our investment philosophy.

I would like to end this New Year’s letter by thanking my client partners for sharing in an

amazing first full calendar year with Double Eagle Partners. This year we added a dozen

new clients and the organic growth of our assets under management (AUM) was an

astounding 238%. I would like to thank each and every one of you for putting your trust

in me.

Our success together will continue by “keeping it simple stupid”. We will avoid those

negative investment tendencies and be the type of investor (and human) who thinks for

ourselves, focuses on the long-term, invests for reasons relevant to us individually while

ignoring short-term price movements, and never forget that investing is a tool to help

you focus on what matters most — namely your relationship with loved ones.

From my family to yours, may you have a Merry Christmas or Happy Hanukkah, and let

us all have a very happy New Year in 2024!

Written by Jim Claire