Shoulda, Woulda, Coulda

This was a phrase my father used to say quite often when one of his four sons expressed regret

over a choice made or an option exercised while we were growing up. But “shoulda woulda coulda” is not

about regret, “shoulda woulda coulda” was used by my Dad to help dismiss our worries and complaints

about decisions we made in the past. We sometimes have these doubts about our investment portfolios

as we move through changing economic cycles, but apparently the Federal Reserve doesn’t experience

any “shoulda woulda coulda” with the choices that they make!

We are currently in uncertain economic times, a lot of which has been caused by the Federal

Reserve and the current Administration’s policy choices during the pandemic, which fueled this current

bout of inflation. Inflation hit 9% in June 2022 after holding near 1% for the better part of the last decade.

While it has recently come down to 3.6%, it is still quite high. This has an adverse effect on our economy

and the financial decisions we consumers have to make each day, whether it is to buy a house or simply if

we can afford to go out to dinner. For investors, it also affects our asset allocations when trying to build an

inflation proof diversified portfolio.

If one had a crystal ball, one could foresee the future and know exactly which asset class was going

to be the best performing in the upcoming year and put all of your eggs in that basket. But of course, we

do not have such a looking glass therefore we must maintain a diversified portfolio to catch the right

investments while mitigating downside risk. While it may be easy to make money in a bull market, it is

harder to manage downside risks to one’s portfolio in the face of uncertain economic times, and that is

part of our strategy at Double Eagle Partners.

With the stock markets at all-time highs, including gold and even Bitcoin hitting all-time highs, it

makes asset allocation and deploying new money even that much more important a risk to be managed.

We want to remain fully invested for the ride, but we know that it is prudent to take some profits at the

same time. We must remain conservative about putting new money to work when the market is at alltime highs, so that is why we choose to dollar-cost-average when buying so as to not go “all-in” at the

worst possible time. My job at Double Eagle Partners is to be the concierge of your portfolio, to manage

such timing and allocation issues. Interesting little tidbit for you; “concierge” is French for “keeper of the

keys” and has a history as the main valet of a manor house who takes care of the invited guests.

The Federal Reserve is supposed to be the “keeper of the keys” for our economy. But they may

have missed their opportunity to properly take care of their invited guests – the American people. The

Federal Reserve waited too long to raise interest rates in 2021 & 2022 because they assumed (incorrectly)

that inflation was “transitory”. Shoulda-Woulda-Coulda!

The Fed is confounded by the fact that inflation is not coming down as fast as they would like, as

they try to return inflation to their targeted 2% level. Somehow the Fed didn’t realize that the fiscal

experiment of Modern Monetary Theory implemented during COVID with trillions of dollars in deficit

spending while flooding liquidity into the markets would eventually have some negative consequences.

They now realize that Modern Monetary Theory is just that, a theory that does not work in practice. As

they try to unwind this liquidity from the financial system, they are going to have to keep interest rates

higher for longer until they can squeeze this excess liquidity that was created out of the system. ShouldaWoulda-Coulda!

The Fed blames stubborn inflation on increased rents and housing prices, while the White House

blames inflation on greedy supermarket chains and “shrinkflation.” But maybe it is caused entirely by

something else. Increased demand.

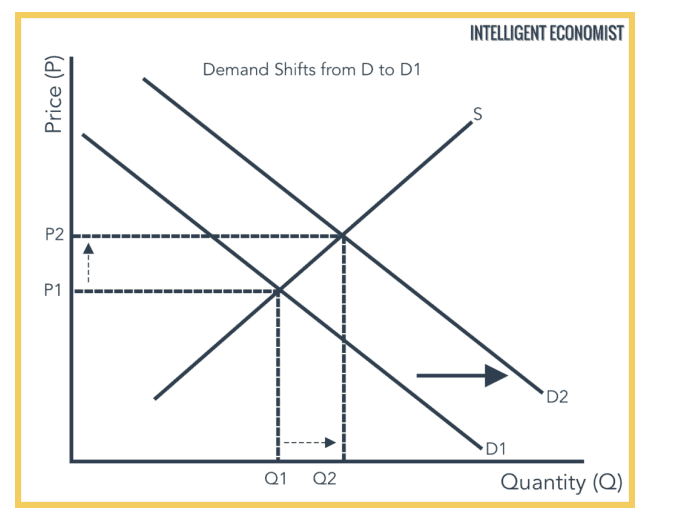

We learned while taking Econ 101 during our freshman year at University of Vermont in 1982 that

an increase in demand for a good without a corresponding increase in supply of that good, will knock the

price of that good out of equilibrium. An increase in demand “shifts” the demand curve to the right and

without an increase in supply, you are going to experience higher equilibrium prices, as the graph below

may bring back memories to some of you.

Finally, I would like to finish with a history lesson. Beginning next week, on May 28th 2024, the Securities and Exchange Commission has mandated that all securities transactions need to take place T+1. This means that all trades must settle one day after their transaction date, hence T+1. When I started working on Wall Street in the summer of 1986, the convention for settlement was T+5. Obviously, we didn’t have the computing power nor the internet back then to quickly process trade tickets, and they were literally handwritten on paper tickets that had five or six carbon copies that needed to be passed around through various departments for settlement – a very time-consuming process! Some of you may remember putting the rolled-up tickets into pneumatic tubes and shooting between floors of the office building ala Buddy The Elf! By 2004 computing power had increased on Wall Street and the Securities and Exchange Commission mandated that we move to T+3 and then T+2 which worked very well for the last 20 years. Now we are on to T+1. What does this mean for you, my clients, and access to the liquidity of your securities portfolio? Well, we can now put your money to work faster in the markets, but more importantly, when you need cash liquidity from your portfolio, we can get that cash the very next day after selling securities.

As always, please feel free to call me should you have any comments, questions, or concerns. And if you would like more information about becoming one our “partners” at Double Eagle, please visit our website – Double Eagle Partners, LLC

Written by Jim Claire