In addition to a rigid religious educational foundation, we were encouraged to

participate on sporting teams and social clubs, primarily to teach us to not run afoul of

the strict disciplinary environment that we attended school under during that generation.

All of this was purposely designed so that each year they could turn more than 400 young

boys into well-rounded gentlemen after four years at Chaminade. And not just any type

of “gentleman,” but rather, a “Chaminade Man.” This concept of being a certain type of

gentlemen was quietly ingrained into students through every interaction during our four

years of high school, whether it be our classroom behavior, our contributions to team

sports or just the camaraderie of sodality within this Marianist Society.

I often find myself dwelling on our school’s motto as I travel through life as well as

while navigating my Wall Street career and now making investment decisions for my

clients at Double Eagle Partners.I would assume that everyone would try to operate under

these auspices, or at least want to. And if we all did behave with these words as our moral

compass in all things that we do in life, then would not all outcomes be beneficial for all

of society at large?

Alas, it does not always work out as such, even with good intentions, because many

who try to “do the right thing” fail to get all four components correct. You can “want” to

do the right thing, but maybe for the wrong reasons. You might do the right thing but too

late, either because of self-interest or possibly waiting for people to notice your efforts of

virtue signaling as might a politician or a celebrity.

I see this negatively affecting Wall Street and the investment management industry

because of decisions that people make when it comes to trying to do the right thing.

Investment decisions should be about efficiently committing capital to profitable

endeavors for the benefit of the investors and eventually the society that they support.

These investment allocation decisions should come about organically as those investing

their capital see a vision for the future that they want to invest in and support, and if they

are correct, they will be rewarded with profitable investment returns and the economy

they support will be better off as well.

All too often we are “told” how to invest and run our businesses by others that do

not have any chips in the game or even a seat at the table. A panoply of alphabet soup

concepts like “ESG” and “DEI” are being mandated or dictated by other alphabet agencies

in the Government such as the SEC, the FDIC and the CFPB, under the auspices of doing

the right thing for our people, our climate and our country.

Environmental Social Governance sounds wonderful, we should want to be good

stewards of the environment, but within the context of existing guidelines. Corporations’

Boards of Directors want to avoid being sued or having negative press coverage, so they

will listen to the HR department about increasing DEI hires and creating equitable

outcomes for all employees, regardless of profitability and shareholder returns that may

be negatively impacted by these inclusion measures. And allowing the Government to

force an industry like the automotive sector (one that has been innovating for 100 years!)

to give up on internal combustion engines for an all-new fleet of vehicles to be EVs within

the next five years so everyone can drive a Tesla? The electric vehicle industry is still so

nascent, with several bankruptcies to boot. But, more importantly, can our electric grid

handle the growth caused by misallocated resources done “for the right reasons?”

But the SEC is trying to force public companies in the other direction. The SEC’s

recent climate disclosure rule will require publicly traded companies to disclose a host of

climate-related information in their periodic reports and registration statements.

Required ESG information includes disclosing climate-related risks; activities to address

or adapt to such risks; information on the company’s board of directors’ oversight of

climate-related risks; and information about any climate-related goals material to the

company’s business and financial condition. In other words, the Government will now

have a new tool to force companies to implement these possibly distracting and wasteful

ideas of ESG regardless of the efficacy.

One such Governmental push towards ESG and inefficient allocations of resources

is the Governments desire to have everyone drive an electric vehicle. When I am helping

my clients to allocate their capital and make investment decisions, I would be in violation

of my fiduciary duty to them to not make sure that we are efficiently committing to

ventures that are economically viable, profitable, and sustainable. I am all for the future

where everyone that wants to drive a Tesla, can drive a Tesla. But right now, more people

want to drive a hybrid vehicle than a fully electric. This is a fact that cannot be mandated

away by the Government in the name of “doing the right thing for the climate.” In many

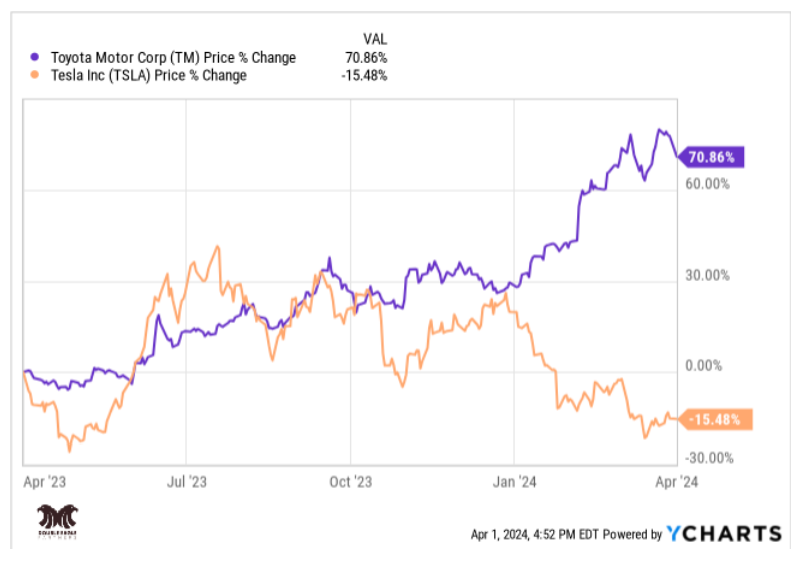

of my clients’ portfolios we sold our Tesla positions last year in favor of Toyota, because

Toyota is committed to making hybrid cars, cars that people actually want to buy and can

afford yet are still pretty good for the environment. And by the way, our investment

returns speak for themselves. Over the last 12 months, Toyota stock is up 70%

while Tesla shares are down 15%!

Doing the right thing, at the right time, for the right reason regardless of who is watching

is sometimes very hard. I am sure my father felt that way when he forced my brothers and

me to go to Chaminade, kicking and screaming after we were accepted. But once we were

involved academically and socially, we understood that only those of us that were

meritoriously worthy of graduating from Chaminade would earn the privilege of

graduating from such a prestigious school. If DEI were to infiltrate this and other

hallowed institutions and great corporations, they would lose the best reason to attend

the school or the reason some companies make great investments through multiple

economic cycles for investors that do the right thing with their capital.